Some Known Facts About Vancouver Tax Accounting Company.

Wiki Article

Some Ideas on Tax Consultant Vancouver You Need To Know

Table of ContentsAn Unbiased View of Tax Accountant In Vancouver, BcThe Main Principles Of Pivot Advantage Accounting And Advisory Inc. In Vancouver The Main Principles Of Small Business Accounting Service In Vancouver The Vancouver Tax Accounting Company PDFsSee This Report about Vancouver Tax Accounting CompanyThe Best Guide To Small Business Accountant VancouverEverything about Vancouver Tax Accounting Company8 Simple Techniques For Pivot Advantage Accounting And Advisory Inc. In Vancouver

We're also readily available to respond to inquiries as they turn up. $2,000 for bookkeeping as well as payroll systems arrangement, From $1,200 monthly (includes software application charges as well as year-end expenses billed month-to-month)These examples have actually been selected as common circumstances to show an array of prices and solutions that we supply, yet it's not an exhaustive list of our solutions.

When it pertains to stabilizing publications, you need to be familiar with debits and credit histories for all of the business's accounts to make certain all transactions are exact and approximately day. An additional significant obligation of Bookkeepers is making sure employees earn money in a timely manner. If pay-roll problems ever emerge, it falls on the Accountant to fix the issue.

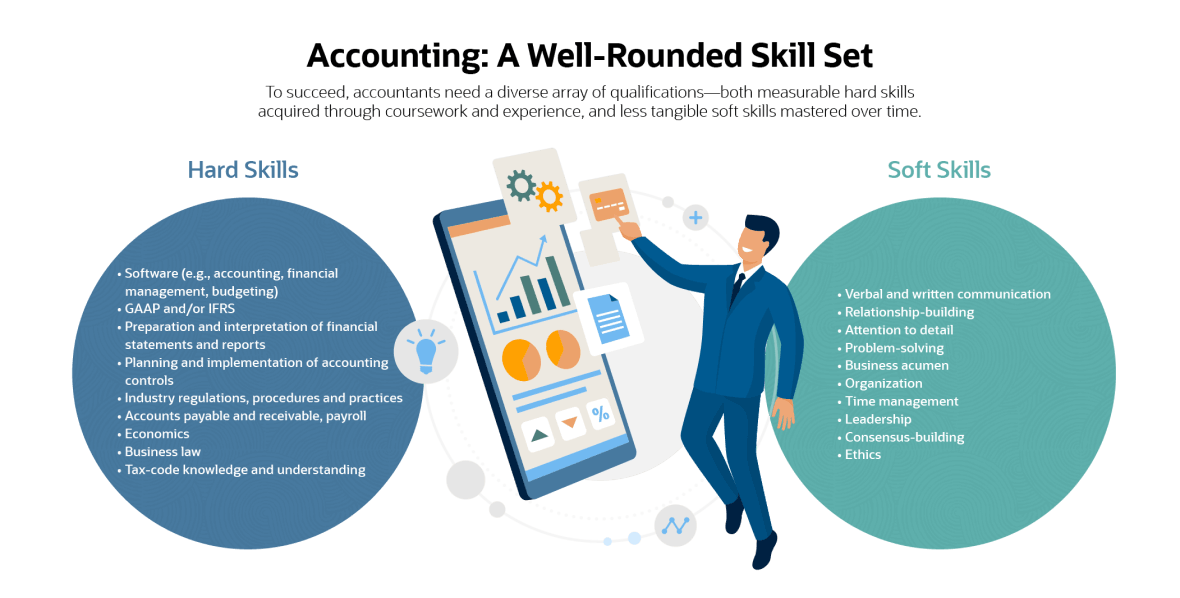

Focus to detail is an exceptionally crucial ability if you desire to be an Accountant. When creating economic declarations, it's pivotal to double-check your work as well as ensure no quantities are missing out on or imprecise. The very best Bookkeepers have a wonderful balance of varying staminas and also difficult and soft skills that make them prime for the duty.

Tax Accountant In Vancouver, Bc Things To Know Before You Buy

Among the major differences in between an accountant and a Bookkeeper is that numerous Bookkeepers work as consultants, moving between clients throughout their occupations. One of the best components regarding being a Bookkeeper is that functions are normally in high demand as smaller sized business don't constantly have the assets to work with a permanent Accounting professional.

Bookkeepers and accounting professionals can offer professional insight, offer suggestions on how to grow and also grow business throughout various other times of the year, draft ideas on just how to lower costs as well as target high-value customers. A bookkeeper can also collaborate with you to find methods to conserve your service cash, which is also less complicated when the right software application is brought into the mix.

The Definitive Guide for Outsourced Cfo Services

And when all parties are on the exact same page today, you're establishing your service up for success in the future. With the best bookkeeping devices in place, you can manage lots of everyday accounting job internally, such as data entry for accounts payable, receivables and also supply. Lots of organization proprietors locate that they can get involved in an information entrance pattern quickly if they have the appropriate sources at their disposal.While she still uses an accountant, she can conveniently take treatment of the basic monetary obligations for her business, which releases up her accounting professional to discover new ways to expand the company as well as recognize better understandings. Certainly, what you perform in your accounting software program need to be entirely independent from the work your accountant does.

By bringing both globes with each other, you can have satisfaction understanding that your business is constantly in good hands, whether their yours or a professional's.

look at here

The smart Trick of Pivot Advantage Accounting And Advisory Inc. In Vancouver That Nobody is Talking About

gained both her bachelor's and also master's in bookkeeping as well as is currently an elderly auditor for DCAA. She attributes her audit levels with aiding her protected her dream job. "It is just due to the fact that I obtained my level that I had the ability to protect my profession with DCAA, and end up being solvent," Pineau claimed.Get in touch with her on Linked, In - Pivot Advantage Accounting and Advisory Inc. in Vancouver.

:max_bytes(150000):strip_icc()/accountant-job-description-4178425-edit-01-fe86b64141eb44498c11502dcb2440c0.jpg)

Cfo Company Vancouver - An Overview

Prior to this can happen, nonetheless, they need to first fix up the annual report accounts as well as assess the operating results to make certain that every little thing is precise. An unfortunate truth for many services is that consumers do not constantly pay their costs on time. Trying to gather overdue invoices and ensure that you obtain paid for the truthful work that you gave is not an easy task to accomplish.These are simply a couple of instances of the lots of monetary tasks that accounting professionals can remove of your plate. Whatever your special needs are as a company, an accountant can aid you as well as can produce a customized remedy that fits completely. There are a few means to deal with getting an accountant, and some are far better than others - small business accounting service in Vancouver.

This can make good sense if you have adequate job for a full-time individual, but beware with this path. Not just is it expensive to put a complete time resource on the pay-roll, however you typically can not cover the whole variety of check my reference solutions that you truly need with why not try here a single person.

Some Ideas on Small Business Accounting Service In Vancouver You Need To Know

Tax accounting professionals are wonderful at what they do, however they typically aren't the best selection when it involves dealing with the recurring accounting as well as month-end accounting jobs. Another preferred option that numerous small companies rely on is outsourced bookkeeping. With this course, you would certainly employ an outsourced accounting company or fractional accountant to manage your bookkeeping demands.You can get the services you require without paying too much. We specialize in helping small services understand their potential and offer market know-how at a portion of the price.

Before this can take place, nevertheless, they should initially integrate the equilibrium sheet accounts as well as analyze the operating results to guarantee that whatever is precise. An unfavorable fact for many businesses is that customers don't always pay their expenses on time. Trying to collect overdue billings and also see to it that you make money for the truthful work that you provided is not an easy job to accomplish.

Some Known Incorrect Statements About Tax Consultant Vancouver

These are just a couple of instances of the several financial tasks that accountants can take off of your plate. Whatever your unique needs are as a service, an accounting professional can aid you and also can develop a customized solution that fits flawlessly. There are a few methods to set about getting an accountant, as well as some are much better than others.

This can make good sense if you have enough help a full-time individual, however be mindful with this path. Not only is it expensive to place a complete time resource on the pay-roll, but you commonly can't cover the whole series of services that you really need with a single person.

Tax accounting professionals are fantastic at what they do, but they typically aren't the most effective option when it pertains to handling the recurring bookkeeping as well as month-end accounting jobs. An additional prominent service that many local business count on is outsourced audit. With this course, you would work with an outsourced accountancy firm or fractional accounting professional to manage your audit demands.

Facts About Small Business Accounting Service In Vancouver Uncovered

You can obtain the solutions you need without overpaying. You can also obtain accessibility to industry or topic knowledge when you need it. Landmark uses outsourced bookkeeping services that are flexible, economical, customizable, and hassle-free. We focus on assisting local business realize their possible as well as provide sector experience at a fraction of the cost.Report this wiki page